DISTRACTION THEFTS ON THE RISE

DISTRACTION THEFTS ON THE RISE

Times are tough. The price of gas rises, so does gas theft. The price of new and used cars is on the rise, so vehicle theft is rising as well. A specific kind of distraction theft is on the rise, and it’s affecting dealers. Two people, could be men or women, will drive on to a dealer’s lot in a nice car, an Escalade, BMW or a Jag. The plates are usually stolen and, as things turn out, the car probably is too. They ask about a nice car, and either they are handed the keys, or in some cases they just grab them, in either case, most dealers report being distracted or even physically assaulted. So far, the calls are coming from the GTA and Southwestern Ontario. Be alert, especially be aware of where those keys are and consider going with the customer on test drives.

|

April 2022

Digital Dealer Registration Testing Begins

As we first reported in the January issue of Front Line, the Ontario government has now announced that new vehicle registration and plating can be done online at a selected group of new vehicle dealers who are testing the digital process. While the timing is not yet known, this will eventually expand to used vehicles and used car dealers who meet yet to be announced security and privacy criteria.

The government officially announced its new “Digital Dealership Registration” (DDR) program on March 22 in London. Twenty new car dealers are participating in the initial testing in various parts of the Province. Dealers using DDR will not need to go to Service Ontario offices to register new vehicles, obtain new vehicle permits or plates for customers.

Used vehicles are not yet part of the program.

Once fully implemented, the new DDR process will allow over 7,000 Ontario dealers access to an online program that will eliminate duplicative paperwork and time consuming trips to Service Ontario offices. Eligible dealers will be able to provide registration and licence plates directly to customers, reducing the administrative burden and saving dealers and customers money and time.

DDR will eventually help move online up to 4.8 million dealership registration transactions annually including the registration of used vehicles, vehicle transfers, and vehicle permit replacements, without having to make a trip to a licence office.

In addition to making vehicle registrations faster and more efficient, the government says DDR will also facilitate more accurate and error free registrations while protecting the security and privacy of personal data. This is a major step in the government’s plan to provide secure digital solutions to the people and businesses of Ontario.

“Our government is reducing red tape for car dealerships by eliminating repetitive paperwork and trips to the registration office,” said Nina Tangri, Associate Minister of Small Business and Red Tape Reduction. “With the introduction of Digital Dealership Registration, businesses will save time and money and customers will be able to enjoy their new vehicle sooner.”

Other than the initial group participating in the testing, the government is not yet inviting interested dealers to apply to join DDR. They have also not announced what specific security and privacy requirements will be necessary for a dealer to be eligible to join DDR, or if the government will provide assistance with the cost of meeting those requirements.

Service Ontario offices are not disappearing. They will remain open and will continue to process vehicle registrations, transfers and issue licence plates for both the public and dealers.

Members who would like to be part of the DDR program should continue to watch for further announcements in Front Line and UCDA Dealer Alerts.

Quebec Purchases

As most dealers know it is crucial to get the permit when buying a vehicle, especially one from another Province. Recently a member was up a creek after buying a car from Quebec from a private seller who had lost their Quebec permit.

Because it was registered as “Sold” on their system, Quebec would not or could not issue a replacement “lost” permit, so we reached out to Service Ontario and this is what they said:

- If the trade was with another dealer, they may have the Preuve d’Enregistrement form which is issued as proof of registration by motor vehicle dealers in Quebec and may be accepted instead (this document is issued by a certified Quebec dealer and replaces the original Quebec vehicle registration).

- If the trade-in was from a customer or if the dealer doesn’t have the document above, they can get written confirmation from the Registrar of the previous jurisdiction. The SAAQ (the Quebec Ministry) could write a letter confirming the vehicle information on file but is not a permit. It’s important to note that if the SAAQ would be faxing this, it has to be sent directly to the Service Ontario office that is facilitating the transaction.

Expired Indian Status Cards

In a concession to the ravages of COVID on every aspect of our economy for the last two years, Indigenous Services Canada was advising merchants that they could accept expired Certificate of Indian Status Cards for tax exempt purchases by Status Indians.

As many dealers already know, this card is crucial to establishing Indian Status for the purpose of exempting a Status Indian purchaser from paying HST on the sale of a motor vehicle (they only pay 5% if delivered at the dealership and no tax if the vehicle is delivered by the dealer to a reserve).

This concession ends as of May 1, 2022. After this date, expired cards are no longer to be accepted for this purpose. Members should charge the applicable tax if the Status Indian Card has expired

For more information on the subject of sales to Status Indians generally, please feel free to visit the UCDA website at:

Free OMVIC Key Elements Course Taught By The UCDA

OMVIC Key Elements Course webinars, taught by UCDA instructors, are still free for dealers and salespeople who have not taken the OMVIC Certification Course since January 1, 2010, or who have never taken the Course at all.

If that describes you, or members of your sales staff, don’t miss out on this unique opportunity to improve your knowledge and become Certified in Automotive Law and Ethics (C.A.L.E.) FREE of Charge.

The half-day webinar is taught by one of the UCDA’s three dynamic instructors.

This is a limited time offer. It won’t last forever!

And there’s more! If you qualify (and of course pass the exam) you’ll also receive a refund from OMVIC for one year of your previously paid dealer or salesperson registration fees.

So what are you waiting for?

If you haven’t taken the OMVIC Certification Course since January 1, 2010, or if you’ve never taken it at all, contact Michelle at [email protected] and register for a webinar TODAY before they fill up.

You’ll be glad that you did!

Two Tier Pricing

Continuing on the theme of strange industry developments resulting from the inventory crunch that we have written about lately, comes two-tier pricing.

This is the practice some dealers have adopted to advertise a vehicle for sale at one price for cash purchasers and another price, usually lower, for finance customers. Indeed, some dealers advertise cars for sale for finance only with no cash purchase option.

Why dealers do this may have a good deal to do with the fact financed deals attract incentives that are more lucrative than a straight cash sale and, with so few vehicles, dealers are looking for a bigger bang for their buck … but is it “legal”?

We asked OMVIC about this practice near the end of last year as we were getting calls from both dealers and consumers (some rather angry) about the practice.

This Is What OMVIC Says …

It is legal. Ultimately, OMVIC’s view is that advertising a finance-only price is an acceptable practice as long as the advertisement includes all the required disclosures in a clear, comprehensible, and prominent manner.

In particular, for those dealers seeking to advertise a price “for finance only”, OMVIC expects that the advertisement will clearly disclose that the price is in fact a “Finance price only”, not to be confused with a cash price.

Clearly identifying what the price represents will reduce misrepresentation and help consumers better understand what the price is reflective of.

New Vehicle Luxury Tax Update

The new luxury car tax is coming into effect on September 1, 2022, for NEW vehicles costing more than $100,000.

The final form this tax will take is still not fully settled, as the Feds have put the proposal out for public comment again, but we are in the home stretch now. If you’d to like read about the tax please find the link here:

To submit comments, the Department of Finance, Canada, invites emails to [email protected].

By way of a reminder, as written in previous Front Lines, the tax DOES NOT APPLY TO USED VEHICLES.

Safety

On occasion, consumers will call the UCDA with concerns about paperwork. Sometimes, they complain, they were not given a copy of their bill of sale or safety.

We think most dealers know the buyer is required to receive a copy of the bill of sale, but it may be that some dealers do not know that the law also requires, on the sale of a certified vehicle, that the buyer has to be given a copy of the Safety Standards Certificate.

This is what the Motor Vehicle Dealers Act says:

Contracts for sales of used motor vehicles

40. (2) A registered motor vehicle dealer shall ensure that any contract that the dealer enters into to sell a used motor vehicle to a purchaser who is not another registered motor vehicle dealer includes, in a clear, comprehensible and prominent manner, the following:

4. If a current safety standards certificate under the Highway Traffic Act has been issued for the vehicle, that certificate … (the bold is our emphasis)

Please make sure on every such sale both the contract and the Safety are provided to the consumer. If you need to make a copy of the Safety for your file, photocopies will do.

Dealer Quiz

- The Motor Vehicle Dealers Act prohibits acting as a dealer without registration by OMVIC (i.e. curbsiding) the minimum fine for which is:

a) $2,500

b) $500

c) $5,000

d) $1,500

e) $1 - The minimum fine for acting as a salesperson when not registered with OMVIC is the same as acting as a dealer without registration (i.e. a curbsider):

True or False? - A corporation convicted of an offence under the Motor Vehicle Dealers Act can face a fine as high as:

a) $5,000

b) $1,500

c) $2,500

d) $250,000

e) $1 - A general dealer can buy vehicles from nondealers, but they do not have to pay them tax except:

a) if the seller is from out of province

b) if the seller is an GST/HST registrant

c) if the vehicle is older than 15 model years

d) when the trade-in value is under $10,000

e) if the vehicle is red - True or False, the 10th digit of a VIN indicates the year a vehicle was built?

True or False?

Free Plate Renewals

The Ontario Government recently announced a series of sweeping measures to save Ontarians money on plate renewals. Naturally, most of the press reports focused on the advantages to consumers who will get refunds for fees already paid and be relieved, going forward, from having to pay to renew their plates.

Many dealers asked about the effect on business, because media reports were sparse on details there.

The answer is while businesses will not be receiving refunds for renewal fees already paid, they will not have to pay plate renewal fees, for regular white plates, dealer plates and service plates, as of March 13, 2022. For example, on a dealer plate, this represents a savings of $175.

The MTO Says …

“For vehicles registered to companies or businesses, refunds would not be provided and unpaid renewal fees for the period of March 2020 to March 2022 would be required to be paid starting as of October 1, 2022.

If approved, beginning March 13, 2022, renewal fees and the requirement to display a validation sticker will also be eliminated for vehicles that are owned by a company or business. The government is proposing to extend validation for passenger vehicles, light-duty trucks, motorcycles and mopeds owned by companies or businesses until September 30, 2022, to provide more time to pay outstanding fees.”

Estate Sales

With an increasingly aging population, the sad reality is that more people are passing away. Even funeral homes are seeing the surge in numbers (obviously Covid is not helping). As a result, dealers are being asked by bereaved families to buy vehicles once owned by the deceased.

There are pitfalls to this, of course. The first and most important one is, “Who has the legal authority to sell a vehicle to a dealer when the owner has died?”.

When a person dies, their assets can be dealt with in any number of ways. If a vehicle was owned jointly, say by a husband and wife, and the husband dies, all the widow has to do is go to a Service Ontario licence office and have the vehicle registered to her name (they will need proof of death like a death certificate).

If the deceased had a Will, then you need to see that and a death certificate. It is best to wait until the Will has been formally ‘probated’ which means a court has approved the Will as genuine and effective. The “Executor” under the Will or “Administrator with a Will” is the person who can sign the contract and legally sell the vehicle to you. Keep a copy of the documents in your file.

If the person died without a Will, then the family will need to obtain a Court Order appointing someone as the “Administrator without a Will” who can act to sell Estate assets, like vehicles, to folks like you. Obviously you will need to see that Court Order. Again, we suggest you keep a copy in your file.

In any case, it is not advisable to make payment to individuals in such a case. Payment should be made to “The Estate of the Deceased”. It is the job of the Executor or Administrator to then take the funds and distribute them to beneficiaries in accordance with the Will or other legal entitlements.

A dealer is not in a position to make those assessments, which is why you should never make payments to individual family members, spouses, children and so on. If you make wrong decisions, you could be faced with angry beneficiaries, or worse, lawsuits.

Answers

- The answer is a). Prohibition

4. (1) No person shall,

(a) act as a motor vehicle dealer unless the person is

registered as a motor vehicle dealer under this Act;

…

(4) The minimum fine upon conviction for an offence

under subsection 4 (1) is $2,500. 2002, c. 30, Sched. B,

s. 32 (4). - True. Prohibition

4. (1) No person shall,

(b) act as a salesperson unless he or she is registered

as a salesperson. 2002, c. 30, Sched. B, s. 4 (1).

…

(4) The minimum fine upon conviction for an offence

under subsection 4 (1) is $2,500. 2002, c. 30, Sched. B,

s. 32 (4). - The answer is d).

Part III Prohibitions re: Practice Prohibition

4. (1) No person shall,

…

Penalties

(3) An individual … and a corporation that is convicted

of an offence under this Act is liable to a fine of not

more than $250,000. 2002, c. 30, Sched. B, s. 32 (3). - The answer is (b).

- True.

April 2022

REOPENING ONTARIO – ROAD MAP EXIT STEP

REOPENING ONTARIO – ROAD MAP EXIT STEP

The following public health and workplace safety measures of interest to motor vehicle dealers will come into effect at 12:01 a.m. on March 1, 2022:

- No capacity limits in all indoor public settings

- No limitations on test drives (aside from mask/face covering and screening requirements)

- Other protective measures, such as mask/face covering requirements and active/passive screening of patrons, will continue to be in place with a specific timeline to lift this measure to be communicated at a later date

- Public health units can deploy local and regional responses based on local health indicators

https://covid-19.ontario.ca/public-health-measures#returning-to-our-plan-to-safely-reopen-ontario

See previous Dealer Alerts at www.ucda.org/dealer-alerts/

February 2022

Used Vehicle Market Survey ... Outlook For 2022

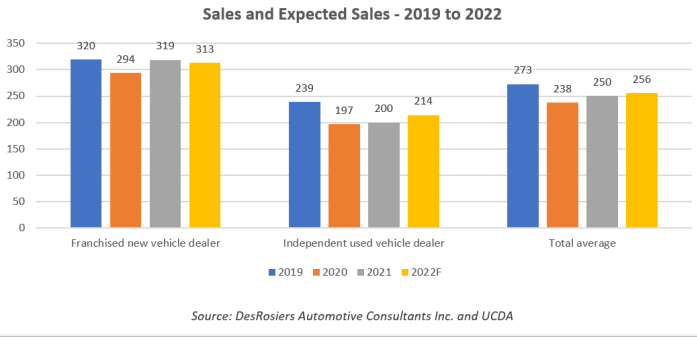

Continuing our partnership with DesRosiers Automotive Consultants (DAC), the UCDA once again reached out to Members to take the pulse of the industry in Ontario.

Close to 450 UCDA Members responded to our survey with both independent dealers and the used vehicle arms of new vehicle dealers offering their perspective on the state of the market moving into 2022.

While demand for used vehicles soared in 2021 as a result of the semiconductor driven shortage of new vehicles, supply constraints did not allow the market to grow to its potential. New vehicle dealers saw a moderate growth in sales per store from 294 in 2020 to 319 units for 2021.

Independent used vehicle dealers had a harder time sourcing used vehicles and saw little growth in 2021, with sales per store rising to only 200 units from 197 in 2020. Interestingly, for 2022, opinions were split with independent used vehicle dealers expecting an increase and franchised new vehicle dealers expecting a moderate drop.

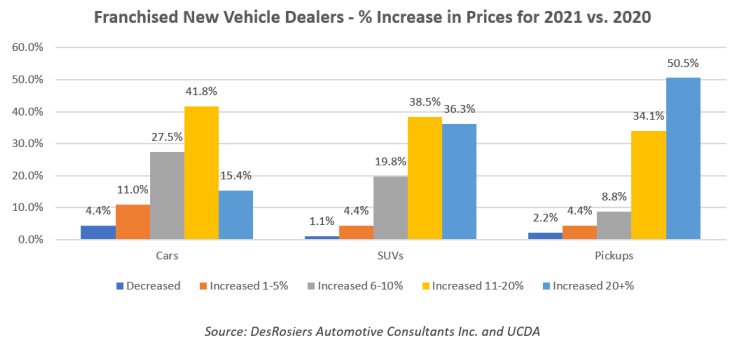

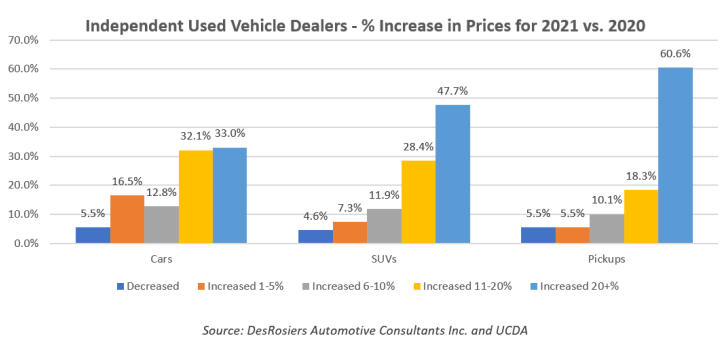

The market situation with booming demand but limited supply obviously led to dramatic price increases. Passenger cars—which have been falling in popularity for years—saw a comparatively mild increase in used prices – although still remarkable in any normal year.

Dealer sentiment showed that passenger car prices saw increases most often in the 11-20% range among new vehicle dealers, and 20+% for independents. For SUVs the pace of inflation was notably greater with close to 47.7% of independents citing increases of over twenty percent for SUVs. Pickups—which were hit hard by the semiconductor shortage and saw significant new vehicle supply issues—saw the most dramatic price increases.

Over half of franchised new vehicle dealers and over sixty percent of independents cited pickup price increases in the twenty plus percent range. “The difficulties in the new vehicle market clearly spilled into the used vehicle market in a dramatic way” commented Andrew King, Managing Partner at DAC “Used vehicle dealers saw prices skyrocket by way of burgeoning demand and limited supply.”

Sad Curbsider

Media reports of a young Ontario man who lost big trying to flip a vehicle for quick profit, missed the point that this activity could be considered curbsiding. If you buy and sell just to make a profit, this is a business activity that requires OMVIC registration.

Reading the stories, it does not sound like this fellow ever intended to insure, plate and drive this vehicle. While it’s sad to see what happened to him, there is a real risk to venturing online with valuable luxury vehicles for sale. Ask any registered motor vehicle dealer!

The 21-year-old (identified as Marco) advertised his uninsured 2017 Mercedes Benz GLE63s for sale on AutoTrader.ca.

Two males, pretending to be potential buyers, contacted him to meet them at a parking lot, where they relieved him of his vehicle in under 10 minutes.

“He was in the car revving the engine, with one foot out the door and I was by the door just holding it open,” Marco told CTV News Toronto. “Then my phone rang and when it did I backed away from the car. He slammed the door, locks it, and tries to drive off.

I’m out of $65,000, which was everything that I had for my young age of 21 and some money I borrowed from my mother as well.”

York Regional Police have received the report, but these stories rarely end well.

Curbsider – Part 2

In another curbsider story, we are reminded that these stories really are the best advertisement to promote purchasing from a dealer!

If consumers don’t already know what a minefield buying privately can be, along comes this story to illustrate it. Dangerous people lurk in the online vehicle-buying world, and looking to make a quick buck includes selling vehicles without declaring past accident history, liens, use, out of province and … odometer inaccuracy.

In this case, the odometer had been “rolled-back” or replaced at some point.

Of course the buyer was told this 2013 Chevy Silverado had 187,000 kms so handing over $11,000 made sense to him. It was only later that he looked at the UVIP and a Carfax that the history showed 455,000 kms in the truck’s past odometer readings.

As usual, the buyer probably does not even know who he handed his money to. The vehicle was not in his name, and if he got a last name or address, that would be surprising. Certainly, a deal started on Facebook and finished in a parking lot sounds just as sketchy as you might imagine.

Loaner Cars And Risk

Courts weigh in from time to time on the issue of loaner cars.

The UCDA has designed a Rental Agreement to try to help navigate the waters for dealers who wish to provide loaner cars to customers whose vehicles are not ready for delivery, or who may be having service work. The agreement can help avoid losses caused by accident or other liabilities while the customer is driving these vehicles. The Agreement, like the law, continues to evolve.

The UCDA Rental Agreement is on page 3 so you can see what it says.

However, a recent court case has thrown some cold water on a dealer’s ability to recover from the customer (or their insurer) in cases where the accident was not the driver’s “fault”.

In Owasco Canadian Car & Camper Rental Ltd. v. Fitzgerald et al., the court focused on Section 263(5)(a.1) of the Ontario Insurance Act which reads:

“(An insured’s) right of action under an agreement … in respect of damages to the insured’s automobile” is limited “to the extent that the person is at fault or negligent in respect of those damages”.

The court goes on to say:

I am satisfied that if s. 263(5)(a.1) does properly apply in this case, it has the effect of entirely extinguishing Owasco’s ability to sue Mr. Fitzgerald under the rental agreement for the damage to the rental car that is at issue in this case. This conclusion necessarily follows from the subsection’s plain wording and from the agreed facts in this case:

… Owasco has “no right of action” against Mr. Fitzgerald under the contract “except to the extent that [he] is at fault or negligent” in respect of the damages to the rental car;

v) Since it is a stipulated fact that Mr. Fitzgerald is entirely blameless for the accident that caused damage to the rental car, Owasco is left with no right of action against him under the rental agreement in respect of this damage.

The court finds the section clearly applies in this case, and the dealer lost the appeal. They will have to absorb the losses caused by the accident to their vehicle.

The whole case can be found here:

Extended Warranty Update

Every couple of years or so, we reach out to extended warranty companies on our list to confirm their products are still underwritten by Ontario Insurance Companies.

In Ontario, dealers can only sell warranties to consumers that are insured or registered with a secured line of credit posted with OMVIC.

The UCDA considers insured products to be the gold standard for consumer and dealer protection, and therefore we recommend our members only sell those products.

For many years, we have invited companies that wish to participate in our list, maintained for our Members, to demonstrate their insurance is proper and in good standing. Those that choose to do so, appear on our list, which we publish in Front Line and online at our extended warranty update https://tinyurl.com/bdf9k949.

Each of the companies listed below have provided the UCDA with a copy of their insurance agreement, along with a written undertaking from the insurer to notify the UCDA in the event the coverage is cancelled or changes are made. The UCDA asks the recognized warranty companies to have insurers provide updates to us, confirming that insurance remains in place.

Verified Insured Warranty Companies

After receiving updates from insurers, here is the current alphabetical list of warranty companies that have met our requirements for insurance recognition:

• Assurant Vehicle Protection Services 1-800-387-0119

• Canada General Warranty Inc. 1-866-320-8975

• Central Administrative Services Company, INC 1-800-222-3020

• Cornerstone United Warranty (XtraRide and AutoXtra) 1-800-774-9992

• Coverage One Warranty 1-866-988-1642

• First Canadian Protection Plans 1-800-381-2580

• Global Warranty 1-800-265-1519

• Guarantee VC/GVC Premium Warranty Co. 1-800-268-3284

• Lubrico Warranty 1-800-668-3331

• Nationwide Auto Warranty 1-888-674-8549

• People’s Choice Warranty Ltd. 1-888-284-2356

• Sym-Tech i-Select Plus 1-800-363-5796 (press 2)

• Veritas Global Protection Services, INC 1-800-222-3020

The UCDA does not endorse any specific warranty company or product, but strongly recommends that Members only offer warranties that are insured by a licensed Ontario insurer.

Salvage Auctions And Liens

Lien searches are useful. Whenever you buy a vehicle, and we do mean whenever, run one. At an average cost of less than $12, it’s the best insurance money can buy. Many dealers are shocked to learn that some auctions don’t do lien searches so, if you don’t do a search, no one else does.

Some of our Members are regular buyers at “salvage” auctions. Some of the bigger players in this area are Copart and Impact Auto Auctions.

For years we have noted that when an insurance company “writes off” a total loss vehicle and sells it at one of these sales, there are often undischarged liens. Many will get discharged once the insured pays the loan with the insurance proceeds. But there have been instances where, for a number of reasons, the loan does not get paid off, or does not get paid off in full, or no one even realizes there is a lien on the unit.

For dealers, this can be a nightmare. These vehicles are usually purchased in pretty rough, non-drivable condition, and it takes a great deal of time and money to make them roadworthy for resale.

Dealers have experienced instances where they invest the time, labour and money in repairs only to find there is a lien registered and they cannot sell the vehicle. Even worse are cases where the dealer does sell it and their customer finds the lien and expects a refund because they cannot sell it, or they have the vehicle repossessed by the lien holder. We have seen, and dealt with, all these scenarios many times.

Of course, everyone blames the dealer for not doing a lien search, although no one has an answer as to what happens if the dealer finds one! We can tell you the solution is time consuming and difficult with minimal co-operation from auctions, insurers and banks.

The dealer, meanwhile, is left to deal with a very angry consumer and no one to help. Naturally, if the dealer is a Member, they turn to the UCDA for help.

Impact Auto Auctions, for example, advise us that their policy on liens is that the buyer is responsible to run a lien search to “confirm that no Lien exists prior to repairing, rebuilding and/ or reselling a Vehicle”.

Copart’s policy is that they expect buyers to report any liens found within 90 days after delivery. They will then assist by enlisting the seller to secure lien discharge as soon as possible. If the lien cannot be removed in a timely manner, the sale would be reversed and the buyer refunded the purchase price, but not the cost of any repairs performed.

We want to see our Members protected. Given the aggravation that liens can pose months and even years after these sales, it’s hard to imagine a better investment than a lien search as part of your buying process.

February 2022

ONTARIO’S PLAN TO REOPEN

ONTARIO’S PLAN TO REOPEN

Yesterday, Premier Doug Ford announced the Plan to safely reopen Ontario.

For dealers, nothing has changed and will not change until February:

- 50 per cent capacity

- music played is not above a decibel level where normal conversation is possible

- safety measures for vehicle test drives sales, such as a maximum of 10 minutes for a test drive, a maximum of two people in a vehicle, including one sales representative, windows must be rolled down, active screening, masking, etc.

- Post visible and conspicuous signs that state the capacity limits in the establishment (50 per cent of the maximum occupant load as calculated in accordance with the Fire Code)

- Ensure physical distancing in-store

- Clean and disinfect commonly touched areas of surfaces and objects, including inside vehicles

Restrictions will loosen further on February 21, 2022 with a further step and additional barriers removed on March 14, 2022. The full plan can be viewed here:

https://covid-19.ontario.ca/public-health-measures#returning-to-our-plan-to-safely-reopen-ontario

January 2022

Ontario Moves Dealers To A Modified Step 2

ONTARIO MOVES DEALERS TO A MODIFIED STEP 2

As some may have already heard, Doug Ford announced he has moved the Province, effective Wednesday, January 5, 2022 at 12:01 a.m. for at least 21 days (until January 26, 2022), subject to trends in public health and health system indicators, to a modified Step 2 in the plan to reopen Ontario.

Essentially, for dealers, the modification affects the advice on test drives:

If the business permits members of the public to test drive any vehicles, boats or watercraft,

- the test drive must be limited to no more than 10 minutes,

- a maximum of two people, including up to one sales representative, may be present in the vehicle, boat or watercraft during the test drive,

iii. if two people who are not members of the same household are present in the vehicle during the test drive, any windows in the vehicle, boat or watercraft must be opened at all times,

- the members of the public must be actively screened in accordance with the advice, recommendations and instructions of the Office of the Chief Medical Officer of Health before they participate in the test drive, and

- all participants in the test drive must wear a mask or face covering in a manner that covers their mouth, nose and chin, unless they are entitled to any exceptions.

All retailers, including dealers, must remain at 50% capacity.

- Post visible and conspicuous signs that state the capacity limits in the establishment (50 per cent of the maximum occupant load as calculated in accordance with the Fire Code)

- Ensure physical distancing in-store

- Clean and disinfect commonly touched areas of surfaces and objects, including inside vehicles

For more detailed and sector-specific guidance please visit https://www.ontario.ca/page/enhancing-public-health-and-workplace-safety-measures-provincewide-shutdown

See previous Dealer Alerts at www.ucda.org/dealer-alerts/