Fraud in Auto Finance

Most of this article is based on information from a webinar put on by our Partner, National Bank, back in June.

Auto financing fraud is a growing concern, with fraud rates climbing and the tactics of con artists becoming increasingly sophisticated. The rise in fraud is not limited to the auto industry; it’s a trend that’s been observed across various sectors, including credit cards, deposit accounts, and telecommunications.

Higher fraud rates for auto financing have been noted in Western Canada, specifically in Vancouver and Calgary, as well as in Southern Ontario. The used car market specifically is experiencing higher rates of financial fraud, with some institutions reporting fraud rates of just over 1%.

Millennials, being credit active and more engaged online, are particularly vulnerable to fraud. Their high volume of credit activity and the sharing of personal information online make them prime targets.

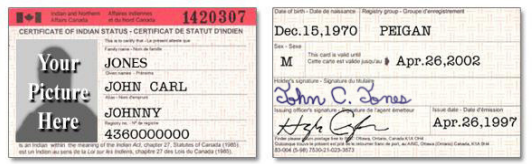

To reduce the risk of fraud during vehicle sales, it is worthwhile for dealers to consider the following suggestions:

- Be consistent with your process.

- Verify the buyer’s identity using their driver’s license along with at least one other form of valid identification (preferably more).

- Confirm that the id is valid, not expired.

- Match the photo on the id to the individual.

- Driver’s license should sound like metal when it’s dropped on a desk.

- Train staff on how to carefully examine id ensuring it hasn’t been altered.

- Watch for multiple fonts (Fraudulent identity will often have multiple)

- Verify employment income by contacting the employers directly.

- Approach transactions with new and out of town customers who demand immediate delivery with a heightened level of caution.

The battle against financing fraud requires awareness from both dealers and lending institutions. By understanding the trends, recognizing the red flags, and taking proactive steps for prevention, dealers can decrease the risks.

Dealer Plates

We still get complaints from members from time to time about incorrect enforcement by police in some areas with respect to the proper use of dealer plates, but these complaints are much more rare than they once were.

Personal Use

Personal use of dealer-owned “passenger-class” vehicles with dealer plates is absolutely legal but not on “commercial vehicles” (ie. cargo vans, ambulances etc.) where the cargo area is separate from the passenger compartment.

Dealer Plates may also be used on dealer-owned vehicles for all purposes related to the sale of the vehicle and this includes commercial vehicles.

Documents Needed!

The dealer plate is not restricted to use by the owner of the dealership. It may be used by anyone that has the permission of the dealership; that would include staff and potential buyers who have the vehicle for testing purposes.

Three documents must be with the vehicle whenever a dealer plate is used … not just when used for private purposes:

- a true copy (meaning a clear copy of the front and back) of the permit for the dealer plate

- the Insurance certificate (pink slip)

- * a true copy of the vehicle permit.

* If the vehicle has recently been purchased, a copy of the Bill of Sale may be accepted by the police.

Please call the UCDA if you would like a handy wallet card you can show the police if you are stopped and asked about your use of the Dealer Plate.

Newer Developments

As of January 1, 2021:

- Dealer plates can be used on a light-duty commercial vehicle (ie. Pickup Trucks), that is part of a dealer’s inventory of motor vehicles and that is “loaded with goods” of a private nature, for private use, provided the manufacturer’s Gross Vehicle Weight Rating of the pickup truck does not exceed 3,400 kg (Reg 628). Pickup trucks displaying Dealer plates while being operated for private use may not tow another vehicle.

The MTO has also issued communications to the enforcement community to clarify that the current Dealer plate regulations support using a Dealer plate in the following situations:

- On a used motor vehicle being transported from auction with no vehicle registration permit, and

- While transporting a new unregistered motor vehicle where only the New Vehicle Information Statement (NVIS) is present.

As always, if you are charged in circumstances you do not believe to be fair or accurate just give us a call at 416-231-2600 or 1-800-268- 2598. We have helpful documents you can show the crown prosecutor or the judge.

Simplicity: KYCS Vehicle Locate Product

KYCS Locate offers a theft recovery solution for dealerships. The self�powered waterproof device is simple to install. Installation does not require installers to cut into the wiring of the vehicle. Since no wiring is disturbed during the installation, dealers and consumer don’t have to worry about the manufacturer’s warranty being voided. It can also be used to secure heavy equipment, RVs, powersports and trailers.

KYCS has no monthly subscription fee, offering consumers a cost�effective solution. KYCS Locate is virtually undetectable by thieves and the device lasts for 5 years. If a consumer’s vehicle is stolen, KYCS Locate is switched into recovery mode, which means that the vehicle can be monitored and provide law enforcement the information they require. These features lead to a higher probability of the vehicle being recovered.

KYCS offers multiple F&I and inventory protection models tailored for dealerships. It includes geofencing capabilities, creating a virtual boundary around your lot.

If your dealership is interested in exploring KYCS Locate, please contact the UCDA or Jay Lyall [email protected].

www.KYCS.ca