Governments at every level are opening their wallets to try and help offset the losses caused to the economy by the COVID-19 virus.

The 2020 Ontario Budget contains many goodies for businesses, some large, some small, and many of which will be of interest to Members.

We have tried to summarize the highlights below:

Electricity Costs

The Province will subsidize up to 16 per cent of electricity costs for industrial users and 14 per cent for commercial users starting Jan, 1, 2021.

Amending Payroll Taxes for Private-Sector Employers

30,000 small businesses with payrolls of less than $1 million will be exempted from paying the Employer Health Tax (EHT).

The EHT exemption (the payroll threshold above which employers are subject to EHT, on an associated basis) had been temporarily increased to $1 million (from $490,000) for 2020. The budget proposes to make the $1 million EHT exemption permanent.

The government is also proposing to increase the payroll threshold for payment of monthly EHT instalments to $1,200,000 (from $600,000), starting 2021.

Amending Business Education Tax (BET)

The province announced it would be levelling the playing field by lowering BET rates on over 94% of all business properties to a rate of 0.88 per cent in 2021 thus creating $450 million in immediate annual savings for Ontario businesses.

Property Tax

The province will provide municipalities with the ability to cut property tax for small businesses and has committed to giving consideration to matching those reductions.

Pending municipal adoption, this could provide small businesses with as much as $385 million in total property tax relief by 2022–23.

This could permit municipalities to:

- adopt a new optional property subclass for small business properties

- reduce property taxes to eligible small business properties

Previously Announced $1,000 Grant

In October the government announced Ontario’s Main Street Recovery Plan. The plan includes: providing $60 million in one-time grants of up to $1,000 for eligible main street small businesses.

The grant is available to help offset the unexpected costs of personal protective equipment (PPE) for businesses with 2 to 9 employees in retail, food and accommodations, and other service sectors.

To help as many businesses as possible, PPE purchases made all the way back until March 17, 2020 can be submitted for reimbursement.

Eligible businesses, whether applying for the Main Street Relief Grant for PPE – or for property tax or energy rebates in affected regions – will be able to do it all through one application on a new online portal.

If you qualify, this is the link where you can apply:

https://tinyurl.com/y37zmaxs.

For a good summary of these and other measures to help business in Ontario please visit https://tinyurl.com/y67bskvh.

Repairs

The Consumer Protection Act requires that repair facilities offer written estimates on all repairs (unless the customer declines and instead authorizes a maximum repair amount which cannot be exceeded).

If the repairer charges a fee for the estimate, and the actual repair is later authorized to proceed, the estimate fee must be waived. The total price cannot exceed the estimate by more than 10%.

Repairers, and dealers with service facilities, need to remember that if a vehicle comes in with a problem that will likely take significant time to diagnose before repairs can even proceed, you are better to bill separately for diagnostic time, rather than charge a fee for an estimate.

You can take verbal authorizations, but in that case you must write down and keep the name of the person giving it. Record the date and time, and if by phone or other means, the phone number or contact by the other means used.

Failure to follow the correct process can mean the repair bill may not have to be paid.

Consult your UCDA Repair Sign, which explains how all this works to your customers.

If you don’t have a Repair Sign visible to the public, as the law requires, please contact the UCDA at 416-231-2600 or 1-800-268-2598 for more information about getting one.

In House Financing

Anytime you allow a vehicle to go out on the road without payment in full there is risk. Many dealers accept that risk and allow customers to finance part or all of their payment over time. We call this “lease to own”, “buy here, pay here” or “in-house financing”.

A lawyer might call it a conditional financing, but whatever you call it, there are things dealers can do to reduce the risk present in all such sales.

Let’s not beat around the bush, the risk is the customer will default, or damage the vehicle, or write it off, or take off with it … and you won’t get paid. You cannot eliminate all the risks, but there are some basic things you can do.

An Ounce of Prevention – Lien Registration

The vehicle should be registered in the consumer’s name to avoid insurance risks and a lien should be registered on the vehicle to secure the dealer’s interest in it.

Insurance

Specify on the contract how much insurance, $1 or $2 million? Collision? Comprehensive?

Ask to be listed not just as a lienholder on the insurance, but also as a co-insured so the insurance company in the event of a claim, is required to treat you just as it would treat the consumer.

Consumer Protection Act

A UCDA Bill of Sale is designed to allow for financing terms to be described, but you probably want to go further and create a payment schedule to set out the payment terms with cost of credit and annual percentage rate clearly described and incorporated into the contract.

A useful website for these calculations is:

https://tinyurl.com/y6sdd2vr

GPS

It can be helpful to use tools to help locate vehicles when and if default happens (and it will from time to time).

You will never be able to eliminate risk, but you can reduce it and if you do, you may find lease to own is an excellent means by which to move more inventory from your lot to the consumer’s driveway.

Vehicle Registration & Bank Loans

When a dealer sells a vehicle to a customer, and assists the customer in finding financing to pay for it, it’s very important that the dealer fully understands the terms of the loan agreement.

Loan Agreements

Loan agreements contain standard contract language about the customer’s obligations to the lender, to maintain adequate insurance, make timely payments, truthfully disclose income and so forth. These agreements also frequently place obligations upon the dealer.

A common contract clause that dealers encounter relates to the issue of vehicle registration. Some loan contract language requires that the dealer ensure that the lender is protected and that the vehicle is registered into the name of the buyer.

Vehicle Registration

With the high cost of insurance, some buyers will want the vehicle to be registered into the name of someone else, to get a lower rate.

For example, the buyer may want the vehicle to be registered into the name of their mother or grandfather, who may be accepted by the insurance company as the primary driver and quote a rate lower than if the buyer alone was the registered owner.

Others may ask you to put the vehicle in the name of a corporation for some perceived tax advantage.

Resist the impulse to just go ahead and do what the customer asks without clearing it with the lender first. Get any direction to do so from the lender in writing.

Don’t Forget About the Lender

Unfortunately, dealers sometimes forget about the lender. One of the most important aspects of the sale, from the lender’s point of view, is that the vehicle will be registered into the name of the buyer.

The lender will register a lien on the vehicle. If the buyer defaults on the loan agreement, the lender will recover the vehicle and sell it to offset its losses.

However, if the dealer does not ensure that the vehicle is registered in the name of the buyer, the lender may not be able to act on their security because the loan agreement and the lien registered on the vehicle, each assume that the vehicle is in the buyer’s name.

If the buyer goes into default on the loan and the lender cannot proceed against the vehicle, it may hold the dealer responsible for its loss. The dealer failed to honour the agreement it made to protect the lender’s security in exchange for the loan in the first place.

Read and understand your obligations under loan agreements. If you are ever unsure about what you may be agreeing to, contact the UCDA Legal Department for guidance.

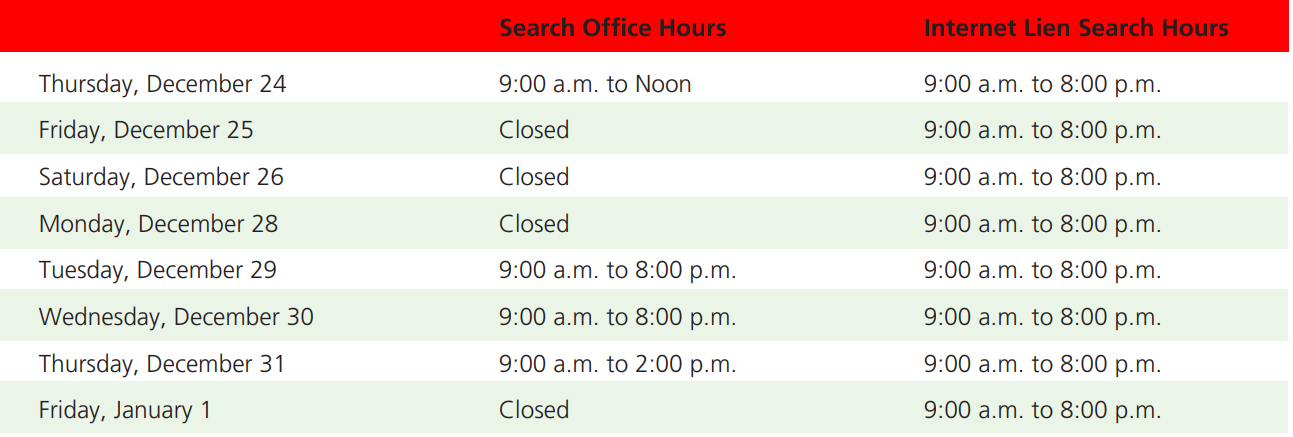

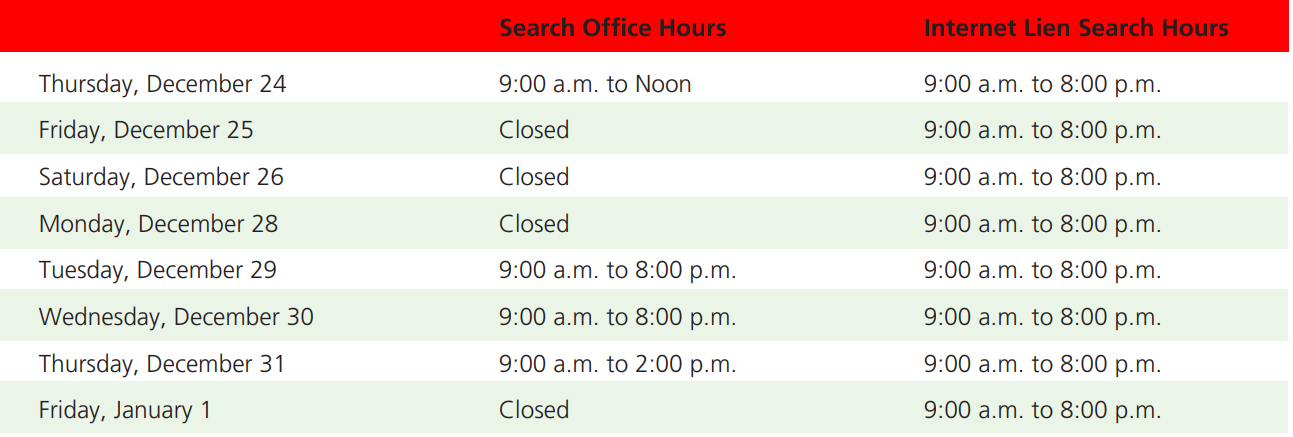

All dealers must be closed on Christmas Day, Friday, December 25 and New Year’s Day, Friday January 1, unless their local municipality has passed a by-law, exempting retail businesses from the requirement to close on these statutory holidays.

Very few municipalities will allow Christmas Day openings, and Members should contact their local municipalities for more information if needed.

All dealers may be open on Boxing Day, Saturday, December 26, should they wish to be. However, please remember that in all cases, staff must be given three days off with pay for Christmas, Boxing Day and New Year’s Day, if not on those days, than on other agreed upon days.

Employees who do not normally work on Saturday, must be given another day off. This could be the following Monday, December 28. Alternatively, it could be Thursday, December 24.

Members can come up with different variants, as long as all staff end up with three paid days off for Christmas, Boxing Day and New Year’s Day.

The UCDA office will be closed on Christmas Day, Monday, December 28 for Boxing Day as well as New Year’s Day.

The UCDA search facility office will be open during the following holiday hours:

We’re always excited to secure a new member service – especially one that we know has your best interests in mind.

Now that Desjardins has wrapped up their credit card processing program altogether, we were tasked to research and find a merchant Point of Sale provider who met our expectations in terms of cost effectiveness, transparency and ease of use.

The UCDA has done just that and has negotiated a very competitive Point of Sale program for processing rates and equipment with Global Payments.

They’ve been in the payments business for over 50 years and are one of Canada’s leading credit card processors.

Global Payments is a leading worldwide provider of payment technology and software solutions. They help UCDA members, like you, simplify the ever-growing complexity of the payment experience so that you can seamlessly accept any form of payment – any time, anywhere, any way.

But they’re more than just payments. With access to emerging technologies and software solutions, you’ll be fully equipped to meet the needs of your customers and keep them coming back.

With Global Payments, You’ll Benefit From:

- Preferred pricing for UCDA members on all credit and debit transaction processing

- Acceptance for all major card brands

- Fleet, commercial and private label card processing

- Gift and loyalty card programs

- Value-added solutions that can help you attract more business, increase revenues and offset your costs

- Satisfaction guaranteed

They also offer both hardwired and cellular mobile devices that are very easily set-up. Members will receive the most current Ingenico terminals, like the Desk5000 countertop terminal or the Move5000 mobile units.

Global Payments may not always have the lowest prices, depending on the types of credit cards that you take, but we are very satisfied that there won’t be any surprises down the line.

In a nutshell, they are committed to delivering world class service and solutions at a competitive price. If you’re interested in signing up, please contact the UCDA office at 416-231-2600 or 1-800-268-2598 and we’ll put you in touch with a local representative!