AUCTION DISCLOSURE ISSUES

We have been receiving a troubling number of calls and emails from Members who, for one reason or another, are unhappy with the way their concerns are being addressed by some on-line auctions.

Increasingly, we are seeing these auctions permit selling dealers to run vehicles under “red light” or “as is declaration,” that have specific problems, like a defective transmission or nonrunning engine, that are not declared. When the buyer protests and seeks arbitration they are, it seems, often told there is no arbitration. In some cases, the failure to declare occurs under a ride and drive, but something expensive like a NAV system is not working, or the vehicle does not “run”.

We have also been asked by a number of Members to seek fuller disclosure of buyer’s fees at auctions. These fees can run as high as 10% or more of the bid value, but they are often not

declared online or at the block. The buyer does not learn what the fee is until after they have bid and it is too late to back out.

At the risk of sounding like a broken record, this is not the legal environment in which modern day motor vehicle dealers operate. The buzzwords today are “FULL DISCLOSURE”. Ontario law requires it, OMVIC enforces it and we hope Ontario auctions, both brick and mortar and online, agree and ensure that it is provided. Without it, dealers cannot pass on the important disclosures they need to give to consumers, much less make informed decisions about buying the unit for the right price in the first place.

Needless to say, as the result of big moves to online auctions by many sellers, especially since the pandemic began, it is even more important that sellers and buyers are not left to guess and wonder.

No auction wants to become a clearing-house for other dealers’ problem vehicles.

All auctions have written rules, and buyers and sellers agree to abide by them in exchange for the chance to buy or sell under the auction’s “roof” or online platform. On occasion, a used car will have defects of one kind or another and the issue is dealt with through the auction’s arbitration process.

If the seller did not make an essential disclosure that the rules (or the MVDA) require, then the seller can be required to take the vehicle back and refund the price paid to the buyer.

While this might sound simple on paper, it is complicated in practice. The auctions derive their rules from a number of sources:

- The Motor Vehicle Dealers Act. Sellers are legally required under the wholesale sections of the MVDA to disclose as many as 21 specific items that may apply to the vehicle. The most common are daily rental, accident damage over $3,000, Out-of-Province and so on. The complete list can be found in Section 5 at https://tinyurl.com/ytd8sc65.

- When you enter the auction you are also agreeing to abide by the auction’s arbitration rules. A copy is available from the auctions. These rules are base on National Auto Auction Association. You need to be aware of the specific disclosure rules and time limits for requesting arbitration.

- Unwritten rules that the auctions have devised to cope with specific concerns and might be best called “policy”.

At the end of the day, the required disclosures are the responsibility of the selling dealer and failure to make disclosure can be enforced by OMVIC. While auctions are exempt from the MVDA, they are expected to ensure that sellers fulfill their disclosure obligations.

This is a complex and difficult area. While we have sympathy for the auctions who have to navigate a minefield of competing concerns; legislation, clients, policy, national arbitrations rules and their own business strategy, we have been hearing about this issue for far too long.

We have, once again, begun a dialogue with the auctions in hopes of trying to help organize a path forward that takes account of everyone’s interests. However, times are too tough for many members to simply stop there.

We would hope that auctions will help create an environment where buyers can have the confidence that they will receive full disclosure of vehicle defects, but if they don’t, we will have to find work-arounds, if need be with OMVIC. We won’t stand idly by if our Members are treated unfairly.

In the meantime… Buyer Beware!

UCDA’s Used Vehicle Industry Survey Member Service

Since the UCDA was formed in 1984 one question that has often been asked … and NEVER accurately answered has been … “How many used cars are sold annually in Ontario?”

We have been asked other questions too. “What are the best selling used cars in Windsor, Ottawa, North Bay?” “What is the best selling used truck?” “What is the average gross profit on used cars?” “How much should I be paying my staff to be competitive?” Nobody knows, because nobody has ever asked the used vehicle dealers of Ontario.

Working with Desrosiers Automotive Consultants we hope to be able to help shed some light on these and other questions.

The first of a series of Member surveys has been completed and more than 650 Members responded. That’s a 13% response rate, which is very good by survey industry standards.

Given the last year, do you want to know what the business looks like, and what the future might look like?

Those Members that completed the survey, and requested to continue receiving them, can request a detailed report analyses by Desrosiers detailing the first dedicated survey of the used vehicle business in Ontario. Please contact the UCDA to request a copy.

Here are some of the highlights:

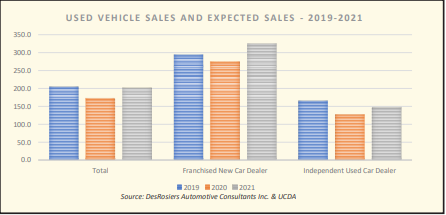

- Members responding to the survey reported an average decline of 15.8% in the number of vehicles sold in 2020, compared with the number in 2019.

- Respondents expected that number to recover significantly in 2021.

- Franchised dealers were most optimistic, expecting sales to be over 10% higher in 2021 than they had been in 2019. Independent dealers, while looking for a significant improvement over 2020, did not expect 2021 to be as good as 2019.

- The average age of used vehicles sold also showed a considerable difference between franchised and independent dealers. Well over 50% of used vehicles sold by franchised dealers in 2020 were between 1 and 3 model years old. Independent dealers’ sales were fairly evenly balanced, with the highest category of 4-7 year old models accounting for just under 40% of units sold.

- One area where the survey results showed stability was in the method of payment used by purchasers in both 2019 and 2020. Less than 40% of vehicles purchased during both years were financed by loans arranged by the dealer or in-house. Almost 60% of purchasers bought with cash or used financing that they arranged themselves, including lines of credit. About 5% of used vehicles in both 2019 and 2020 were leased.

Do I Have To Confirm Insurance?

One UCDA Member would tell you “Yes”!

The Member sold a vehicle in 2018 and the customer gave them what he said was his insurance policy number. It was enough to get the vehicle plated. Unfortunately, when he got in an accident, it turned out the policy number, while valid, was not his.

Now the dealer is among the parties being sued by the accident victim. They wish they had something in the file they could show the judge when this comes to trial. Always get a binder agreement or pink slip faxed or emailed from the insurance company. Don’t hesitate to call the broker to confirm the arrangements (an excellent practice) and the information provided, especially if no written confirmation has yet been received from the insurer.

Watch Your “Cats”

Catalytic Converters (commonly referred to as “cats”) are unassuming and somewhat ugly looking devices that nestle within exhaust systems and clean the pollutants from exhaust gasses quite efficiently.

As dealers know, cats are not cheap to replace and to some criminals they are worth their weight in gold … not so much for what they do, as to what is in them.

Cats contain valuable metals such as platinum, palladium and rhodium. Depending on market conditions, these substances can fetch more cash than gold.

So, needless to say, guard your vehicles against opportunistic thieves looking to steal your “cats”. They are not hard to steal given they are located in an exposed area under the vehicle and can be removed very swiftly if you have the right tools and the know-how.

Indeed, the UCDA, located as we are in an industrial area with some vehicle repair shops nearby, have neighbours who have already fallen victim to these crimes of opportunity, and this on the heels of media reports warning about the very same thing all over Canada:

Chrysler Leaves CAMVAP

Without much fanfare, and in the midst of many other distractions, Fiat Chrysler Automobiles Canada has announced, effective December 31, 2020, their decision to pull out of the Canadian Motor Vehicle Arbitration Plan (“CAMVAP”).

It will be interesting to see if this prompts louder calls from consumer groups for a lemon law in Canada, similar to the approach that exists in the U.S.

CAMVAP is available to consumers who are unhappy with defects in their new or newish car or how their factory warranty is being applied.

Qualified vehicle (generally current and previous 4 model years old under 160,000 kms) owners can engage their vehicle’s manufacturer in binding arbitration through CAMVAP. CAMVAP have the power to order the manufacturer, among other things, to buy-back the car or fix it.

Dealers are required, on the sale of any vehicle, to identify if the maker of the car participates in CAMVAP … now they will need to add Chrysler to the list of those who do not.

Users of UCDA used sales/lease forms will recognize this question on their forms:

MANUFACTURER PARTICIPATES IN CANADIAN MOTOR VEHICLE ARBITRATION PLAN (CAMVAP) YES __ NO __

CAMVAP STATEMENT ON REVERSE (NOT ALL VEHICLES QUALIFY)

Here are the manufacturers who still participate:

Ford * GM * Honda

Hyundai * Jaguar / Land Rover * KIA

Mazda * Mercedes-Benz * Nissan

Porsche * Subaru * Toyota

Volkswagen / Audi * Volvo

Leaving the ones who don’t:

Chrysler * Mitsubishi * BMW

*exotics (Ferrari, Lamborghini, Maserati, Bentley, etc.)

Cryptocurrency

You may have heard about cryptocurrency. You have no doubt heard about it from your kids, or in the media, or from the “internet”.

You may not understand it. You are not alone.

Without getting too deep into the blow-by-blow explanations, suffice it to say this “new” form of exchange is growing in popularity and assumedly in value amongst those ‘in the know’.

But no form of exchange is any fun if you can’t buy things with it like land, boats, planes or … cars or trucks.

Dealers may be asked more and more about accepting payment with some form of cryptocurrency, the most commonly known version of which is called “bitcoin”.

You may have heard news reporting that a dealer group in Quebec is going to accept cryptocurrency in payment for used and new motor vehicles in that Province.

We had a dealer recently ask us if he is “allowed” to accept such a currency as payment for a car. Our answer was “Yes”!

Turns out, you can accept a truckload of chickens if you want to. If it has value to you, then go for it.

But … and it’s a big but … don’t forget the Canada Revenue Agency.

The CRA do not accept cryptocurrency, so you will need to remit the correct HST to the CRA on the fair value of the vehicle being sold in what we still like to refer to as actual “money”!

Oh, and by the way, the CRA does not accept chickens either!

Join Now To Win

Join SiriusXM’s FREE Pre-Owned program by April 9th, 2021 for a chance to walk away with the ultimate golf prize pack! One lucky participating Dealer will have the chance to win a Garmin Golf GPS Watch, Gift Cards to GolfNow and Golf Town, premium golfing equipment and more.

Enroll today: www.siriusxm.ca/UCDA

Learn And Listen For Free

We’ve added a new training module to our Dealer Training Portal – for each module completed, you receive three months of free streaming. Be sure to check out our social channels to find out when module eight goes live and earn up to two years of free streaming!

Feeling Social?

Start following us on Instagram, Facebook, LinkedIn and Twitter for all the latest dealer programs, industry news and exclusive contests! Check out our latest giveaway for your chance to win one of three golf prize packs valued at over $300.