UCDA 35TH ANNIVERSARY CELEBRATION AT MANHEIM TORONTO

The UCDA was founded by a small group of dealers in 1984, including our first Executive Director, Bob Beattie.

Thanks to their tireless efforts along with the generous assistance of Homer Stephens and his wife Ruth HartStephens, who actively promoted the benefits of joining the fledgling association at the Toronto Auto Auction, membership soon numbered in the hundreds. The momentum has continued without slowing ever since and this summer UCDA membership soared past 5,000 members!

On November 26, UCDA directors and staff were on hand as Manheim Toronto hosted a celebration of the UCDA’s 35th anniversary. Dealers at the auction were treated to a delicious lunch and anniversary cake for dessert.

Following the sale, a special draw was held for a 65 inch LG television. Dealers that bought or sold a vehicle on the UCDA lane that day were eligible to win. Robinson Buick GMC Ltd. was the lucky winner !

A few photos of the celebration.

Read Your Bill of Sale

Yes really; read the whole thing, front and back.

It’s a legal contract. It describes the rights and obligations of the buyer and seller (you). We have all become a little numb to standard form contracts. They are slid in front of us when we rent a car, do a home renovation or buy a cell phone. And let’s not forget the 15 plus page micro-print contracts displayed to us when we buy, book or reserve things on-line that literally no one reads.

We want you to break that habit when it comes to your standard form bills of sale and leases. They all have clauses designed to protect you and some that are important for you to follow in relation to your customer.

For example, we have mentioned many times how often we get calls from consumers and dealers over deposit disputes. When a buyer wants to back out of a deal, they will sometimes call us weeks after the deal was cancelled. Not only did they not get a refund of their deposit (which is what they really wanted), but they also did not receive a letter from the dealer explaining what the process is.

If you read the terms on your contract, you will see that it contains a clause requiring that you send a notice and follow certain steps with respect to a deposit. On UCDA forms, it is clause 4 on used and new vehicle bills of sale, and clause 17 on UCDA lease agreements.

It can be more than embarrassing to a dealer who ends up in front of OMVIC or a court over a deposit dispute if the dealer has failed to follow the requirements of their own contract! More than embarrassing … it can be fatal to the dealer’s case.

In another example, we took a call in October from a dealer on a new car sale. He was waiting on a new build since April. The delay was upsetting the customer, for sure, but also causing the dealer concern. The valuable trade-in appraised back in April was now, months later, depreciated and, the dealer was feeling trapped in a deal that was swiftly looking sour to him.

He wasn’t trapped. In fact, this situation was anticipated in the contract. He didn’t even know it. He was told to flip over his UCDA New Vehicle Bill of Sale and read clause 5 which provides:

5. DELIVERY (NEW VEHICLES): If the vehicle being purchased is a new vehicle which the dealer is ordering from the manufacturer and the dealer is unable to deliver the vehicle to you within ninety (90) days of the date of this agreement, the dealer will notify you in writing. The dealer or you may then cancel this agreement, in writing. This agreement will automatically be cancelled five (5) days following receipt of notice of delay unless a new delivery date is agreed to in writing. Further delays in the delivery date will result in automatic cancellation of this agreement. The dealer will return your deposit if this agreement is cancelled as a result of this clause and no further obligations will be owing.

Contracts in use in our industry are not overly complex. UCDA forms are designed to be as clearly worded and concise as possible, but you have to read and understand them to enjoy the full benefit of the protections and guidance they provide to both you and your customers.

Extended Warranty Update

The UCDA regularly updates the list of extended warranty companies that have satisfied the UCDA that their warranties are fully insured by a licensed Ontario insurer.

Each of the companies listed below have provided the UCDA with a copy of its insurance agreement, and a written undertaking by the insurer to notify the UCDA in the event that the coverage is cancelled or changes are made. The UCDA asks the recognized warranty companies to have insurers provide annual updates to us, confirming that insurance remains in place.

Verified Insured Warranty Companies

After receiving updates from insurers, here is the current alphabetical list of warranty companies, updated as of November 1, 2019, that have met our requirements for insurance recognition.

| Canada General Warranty Inc. | 1-866-320-8975 |

| Cornerstone United Warranty (XtraRide and AutoXtra) | 1-800-774-9992 |

| Coverage One Warranty | 1-866-320-8975 |

| D.I.S.C.C. Enterprises Ltd | 1-800-663-1303 |

| First Canadian Protection | 1-800-381-2580 |

| Global Warranty | 1-800-265-1519 |

| Lubrico Warranty | 1-800-668-3331 |

| Nationwide Auto Warranty | 1-888-674-8549 |

| Specialty Administrative Services, LLC | 1-888-668-4360 |

| Sym-Tech i-Select Plus | 1-800-363-5796 |

The UCDA does not endorse any specific warranty company or product, but strongly recommends that members only offer warranties that are insured by a licensed Ontario insurer.

MVDA Regulations

The Motor Vehicle Dealers Act, 2002 prohibits dealers from offering third party warranties to their customers unless:

- The warranty is insured by a licensed Ontario insurer; or

- The warranty company has posted a $500,000 irrevocable letter of credit to the Motor Vehicle Dealers Compensation Fund

OMVIC also lists the companies it recognizes in each category on its website:

The UCDA considers full insurance coverage to be the best form of protection to adequately shield consumers and dealers in the event that a warranty provider fails to honour its obligations. A letter of credit can quickly be used up, which could then potentially leave the dealer that sold a failed warranty on the hook for consumer claims.

Contact James Hamilton at [email protected] if you’d like more information.

Insurance Rates

The UCDA’s Insurance Program is celebrating 25 years of providing Members with a quality, stable and affordable service.

Over this time, our program has performed better than most rate groups and hasn’t seen significant rate increases. On the contrary, members get rebates for being claims free.

But things are changing. Over the past ten years, cars and trucks have become high tech marvels and high performance luxury machines. In the old days, a simple fender bender or bumper “bump” was a nothing claim, but today that claim can be in the thousands of dollars. There is no such thing as a “nothing claim” today.

Another term dealers need to understand is “frequency”. The more often “you come to the well”, the bigger the insurance risk you are. Even if you didn’t cause the accident, the more times you are involved in one, the more problematic you become for the insurer.

“No Fault” is Not “No Cost”

Probably the most misused and misunderstood term in the insurance world is “No Fault”. If you are involved in an accident and it is determined by the police that you didn’t cause it, it doesn’t mean that there won’t be a claim against your policy. Your policy pays to fix your car and if you are hurt, the cost to your policy could be hundreds of thousands of dollars.

Add that to the accident benefits and bodily injury legal battles and we have an insurance industry crying the blues. According to them “they are in crisis”.

The Facility Fund

This is another insurance term dealers need to understand. Under Ontario law the insurance industry must offer you insurance. In their wisdom, the industry developed the “Facility Fund”. This is where high frequency claimers, whether at fault or not, get their insurance, when no one else will insure them.

It is not the place you want to end up. The annual premium of a recent past member went from$7,500 a year to $97,000 a year in facility, due to frequent at fault and not at fault accidents!

This year, many insurance companies have dropped dealers, taxi/ride-share, and trucking programs entirely due to significant losses.

The UCDA will continue our efforts to work with our partners to get the best deal possible for Members. We have a proven track record and you have proven to be a good risk over the years. We will keep you advised.

Having an accident or any loss incident is why you have insurance. However, today you need to make claims wisely, because more than ever, you need insurance to stay in business.

Exporting Concerns

We have written in the pages of Front Line repeatedly warning members against the practice of exempting “export buyers” from paying HST. There are several good reasons to avoid this:

- You are underwriting the buyer’s exemption. Canada Revenue Agency, not dealers, should be deciding whether HST paid by a purchaser is refundable.

- It is difficult to export vehicles properly. You can’t give delivery to the buyer in Canada and giving it to a “shipper” is not enough. You need solid and correct paperwork to back it up; paperwork few dealers receive and which may be hard to get, time consuming to collect and complex to organize.

- In many cases “export buyers” are actually curbsiders in the business of exporting vehicles overseas without being registered with OMVIC.

Think a “bill of lading” is good enough? Think again.

First of all, a bill of lading is not something a shipper in Mississauga can give you. It is issued only when the vehicle is loaded on a ship in Halifax, Montreal, Vancouver, or from whatever port it is being shipped.

Also, we have heard of Canada Revenue Agency auditors asking dealers for proof of entry from countries such as Nigeria, Dubai, Kazakhstan and others. It must show that the vehicle actually arrived and was “registered” there. What form such proof would take … WHO KNOWS?

Care to guess how “easy” it will be to get this paperwork from some of these places with different degrees of social order not to mention cultures, language and practices?

Our advice (unless selling to a Status Indian and following correct procedures); charge HST on every sale no matter where the buyer says the vehicle is going.

If you decide to proceed and not collect and remit HST, be sure to handle the export yourself and use a trusted shipper who is working for you and who will help ensure you are in compliance. Learn the rules and FOLLOW THEM to the letter.

The rules being cited by the CRA can be found at https://tinyurl.com/t7foyoz.

Small Claims … Getting Bigger

The Ontario Government has announced that, effective January 1, 2020, the limit for lawsuits in Small Claims Court will increase from $25,000 to $35,000.

This is the first increase in ten years (when it was increased in 2010 from $10,000 to $25,000) and should reduce the strain on caseloads at the higher court levels. It will also make it easier for parties to sue for higher sums of money without needing to retain a lawyer.

Holiday Hours

Dealers must be closed on Christmas Day, Wednesday December 25 and New Year’s Day, Wednesday January 1, unless their local municipality has passed a by-law, exempting retail businesses from the requirement to close on these statutory holidays. Very few municipalities will allow Christmas Day openings, and members should contact their local municipalities for more information if needed.

All dealers may be open on Boxing Day, Thursday December 26, should they wish to be. However, members must remember that in all cases, staff must be given three days off with pay for Christmas, Boxing Day and New Year’s Day, if not on those days, than on other agreed upon days.

Dealers have some options when it comes to Boxing Day. For example, they may choose to be open on Thursday, December 26th and be closed on Christmas Eve, Tuesday, December 24th.

Another option would be to be open with partial staff on both December 24th and 26th, as long as all staff get three paid days off for all the required holidays. Dealers can come up with different variants on this, as long as all staff end up with three paid days off for Christmas, Boxing Day and New Year’s Day. Staff must agree to the days.

The UCDA office will be closed from Christmas Day until Monday, December 30. The office will also be closed on Wednesday, January 1st.

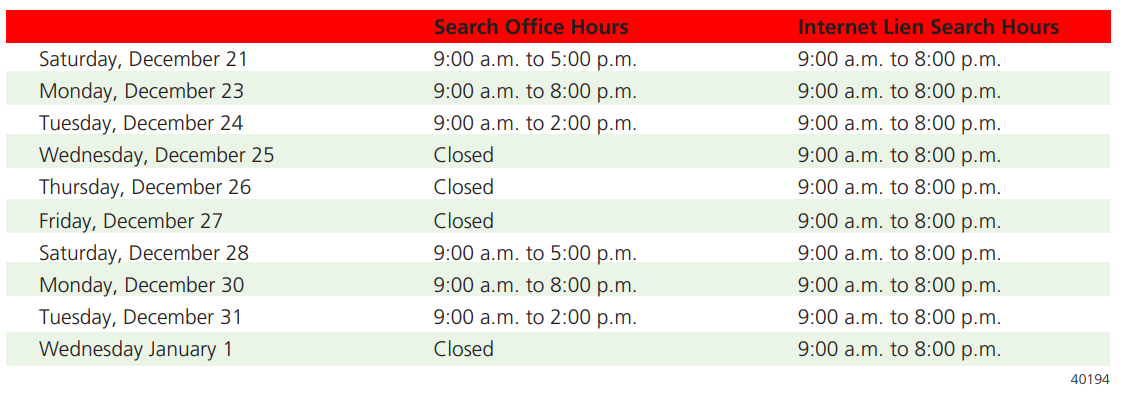

The UCDA search facility office will be open as indicated below: